Conditional Permanent Residence and How to Remove the Conditions

Conditional Permanent Residence and How to Remove the Conditions

A conditional permanent resident receives a green card valid for 2 years. In order to remain a permanent resident, a conditional permanent resident must file a petition to remove the condition during the 90 days before the card expires. The conditional card cannot be renewed. The conditions must be removed or you will lose your permanent resident status.

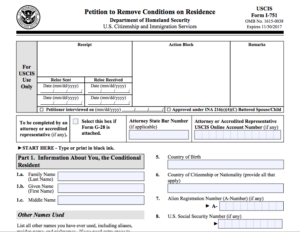

To remove the conditions on a green card based on marriage, you must file Form I-751,Petition to Remove the Conditions of Residence.

1.What Is the Purpose of Form I-751?

This petition is used by a conditional resident who obtained status through marriage, to request that U.S. Citizenship and Immigration Services (USCIS) remove the conditions on his or her residence.

2. Who May File Form I-751?

If you were granted conditional resident status through marriage to a U.S. citizen or lawful permanent resident, use Form I-751, Petition to Remove Conditions on Residence, to file for the removal of those conditions.

If you have dependent children who acquired conditional resident status on the same day as you or within 90 days thereafter, then include the names and Alien Registration Numbers (A-Numbers) of these children in Part 5. of Form I-751 in order to request that the conditions on their status be removed as well.

If you have dependent children who did not acquire conditional resident status on the same day as you or within 90 days thereafter, or if the conditional resident parent is deceased, then those dependent children must each file Form I-751 separately to have the conditions on their status removed.

If you are still married, then file Form I-751 jointly with your spouse through whom you obtained conditional status. However, you may file Form I-751 without your spouse if:

- You entered the marriage in good faith, but your spouse subsequently died;

- You entered the marriage in good faith, but the marriage was later terminated due to divorce or annulment;

- You entered the marriage in good faith, but you have been battered or subject to extreme cruelty by your petitioning spouse; or

- Your conditional resident parent entered the marriage in good faith, but you have been battered or subject to extreme cruelty by your parent’s U.S. citizen or lawful permanent resident spouse or by your conditional resident parent; or

- The termination of your status and removal from the United States would result in extreme hardship.

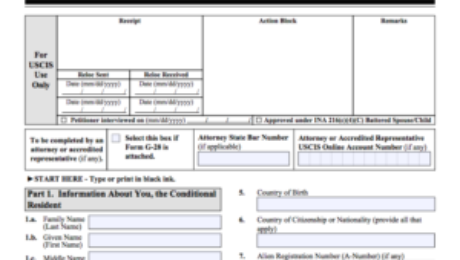

3. How to Fill Out Form I-751. Please find the sections information listed in Form I-751 requested in Part1-11 as below.

(Form I-751)

Part 1. Information About You, the Conditional Resident

Part 2. Biographic Information

Part 3. Basis for Petition

Part 4. Information About the U.S. Citizen or Lawful Permanent Resident Spouse.

Part 5. Information About Your Children

Part 6. Accommodations for Individuals With Disabilities and/or Impairments

Part 7. Petitioner’s Statement, Contact Information, Acknowledgement of Appointment at USCIS Application Support Center, Certification, and Signature

Part 8. Spouse’s or Individual Listed in Part 4.’s Statement, Contact Information, Acknowledgement of Appointment USCIS Application Support Center, Certification, and Signature

Part 9. Interpreter’s Contact Information, Certification, and Signature

Part 10. Contact Information, Statement, Certification, and Signature of the Person Preparing this Petition, If Other Than the Petitioner

Part 11. Additional Information

4. At the time of filing, you must also submit “Initial Evidence”.

- Permanent Resident Card

- Evidence of the Relationship

- Relevant required proof of the situation as below: If you are filing as an individual due to the death of your spouse / your marriage has been terminated/ You and or your conditional resident child were battered or subjected to extreme cruelty/ “extreme hardship”

- Criminal History

Reference: https://www.uscis.gov/

Disclaimer: The Contents of this web site is for informational purposes and should not be considered legal advice. This web page may be considered advertising under Massachusetts Supreme Judicial Court Rules, and it does not establish an attorney-client relationship

We invite you to contact us and welcome your calls, letters and electronic mail. Contacting us does not create an attorney-client relationship. Legal advice and representation can only be obtained upon retaining our firm and the execution of a written agreement for the rendering of specific legal services. Augen Law Offices value your privacy and respect the attorney-client privilege

Augen Law Offices

Address: 21 McGrath Hwy, Suite 205, and Quincy, MA 02169

Email: kaugen@augenlaw.com

Tel: 857-526-6042

Wechat ID: augenlawyers

- Published in Immigration Law

Eviction for Landlords in Massachusetts

Eviction for Landlords in Massachusetts

An eviction is the process of obtaining a court order to remove a tenant and other occupants from a rental property. The landlord or owner can evict someone from his or her property after receiving a court order. The tenant, who is renting the property from the landlord, and any other occupants, can be evicted.

In Massachusetts, it is illegal for a landlord, on his or her own, to remove tenants and occupants and their belongings from a rented apartment, room, or home without first getting a court order. The court case that a landlord files to get a court order is called summary process (the legal term for an eviction).

The court order that allows a landlord to evict a tenant is called an execution. Even after a landlord gets an execution, only a sheriff or constable can move a tenant and his or her belongings out of the property.

1. Can I sue my tenant for money damages in a summary process (eviction) case?

In a summary process case, the landlord can sue the tenant for unpaid rent, even if the tenancy was terminated for a reason other than nonpayment of rent. The summons and complaint form includes a section for the landlord to specify the rent that is owed. However, the landlord cannot include a claim for other types of damages, such as property damage or unpaid utilities, in a summary process case. The landlord can file a separate civil or small claims case to recover damages other than unpaid rent.

2. Can I sue my tenant for unpaid rent without filing a summary process case?

Yes. The landlord can sue the tenant for unpaid rent (or for other damages) in either a civil or a small claims case. The landlord may consider taking such actions if the tenant owes rent and has moved out before the landlord files an eviction case. The procedures for civil actions are governed by the Massachusetts Rules of Civil Procedure. Normally, it is advisable to consult an attorney before suing a tenant for money damages in a civil action. On the other hand, the small claims procedure is designed to provide an informal process for litigants who wish to proceed without an attorney. The procedures for small claims action are governed by the Massachusetts Uniform Small Claims Rules. There is a $7,000 ceiling (exclusive of punitive damages) on the amount of money damages that can be recovered in a small claims case. Thus, if a tenant owes $9,000 in rent, a small claims judgment will be limited to $7,000 and the $2,000 portion of the unpaid rent debt will be waived.

Reference: https://www.mass.gov/

Disclaimer: The Contents of this web site is for informational purposes and should not be considered legal advice. This web page may be considered advertising under Massachusetts Supreme Judicial Court Rules, and it does not establish an attorney-client relationship

We invite you to contact us and welcome your calls, letters and electronic mail. Contacting us does not create an attorney-client relationship. Legal advice and representation can only be obtained upon retaining our firm and the execution of a written agreement for the rendering of specific legal services. Augen Law Offices value your privacy and respect the attorney-client privilege

Augen Law Offices

Address: 21 McGrath Hwy, Suite 205, and Quincy, MA 02169

Email: kaugen@augenlaw.com

Tel: 857-526-6042

Wechat ID: augenlawyers

- Published in Landlord and Tenant Law

Work Permits and Social Security Numbers/ ITIN

Immigrants cannot independently apply for work permits also called “Employment Authorization” or Social Security Numbers unless they have some immigration status, such as being a citizen, lawful permanent resident (green card holder), temporary protected status holder, refugee, asylee, or other status that grants work authorization.

Immigrants can still pay taxes by using what is known as an “individual tax identification number” (ITIN). An ITIN is not a social security number. ITINs are issued regardless of immigration status because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code.

1. Social Security numbers

In the United States, a Social Security number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act, codified as 42 U.S.C. § 405(c)(2).

Three different types of Social Security cards are issued. The most common type contains the cardholder’s name and number. Such cards are issued to U.S. citizens and U.S. permanent residents. There are also two restricted types of Social Security cards.

Social Security numbers are used to report a person’s wages to the government and to determine a person’s eligibility for Social Security benefits. You need a Social Security number to work, collect Social Security benefits, and receive some other government services.

Lawfully admitted noncitizens can get many benefits and services without a Social Security number. You don’t need a number to get a driver’s license, register for school, get private health insurance, or apply for school lunch programs or subsidized housing.

Some organizations use Social Security numbers to identify you in their records. Most, however, will identify you by some other means if you request it.

2. ITIN

Who needs an ITIN?

IRS issues ITINs to foreign nationals and others who have federal tax reporting or filing requirements and do not qualify for SSNs. A non-resident alien individual not eligible for a SSN who is required to file a U.S. tax return only to claim a refund of tax under the provisions of a U.S. tax treaty needs an ITIN.

Other examples of individuals who need ITINs include:

- A nonresident alien required to file a U.S. tax return

- A U.S. resident alien (based on days present in the United States) filing a U.S. tax return

- A dependent or spouse of a U.S. citizen/resident alien

- A dependent or spouse of a nonresident alien visa holder

What is an ITIN used for?

ITINs are for federal tax reporting only, and are not intended to serve any other purpose. IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security Numbers (SSNs).

- An ITIN does not:

- Authorize work in the U.S.

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

Reference: https://www.irs.gov/

https://www.ssa.gov/ssnumber/cards.htm

https://en.wikipedia.org/wiki/Social_Security_number

Massachusetts Law Reform Institute

Disclaimer: The Contents of this web site is for informational purposes and should not be considered legal advice. This web page may be considered advertising under Massachusetts Supreme Judicial Court Rules, and it does not establish an attorney-client relationship

We invite you to contact us and welcome your calls, letters and electronic mail. Contacting us does not create an attorney-client relationship. Legal advice and representation can only be obtained upon retaining our firm and the execution of a written agreement for the rendering of specific legal services. Augen Law Offices value your privacy and respect the attorney-client privilege

Augen Law Offices

Address: 21 McGrath Hwy, Suite 205, and Quincy, MA 02169

Email: kaugen@augenlaw.com

Tel: 857-526-6042

Wechat ID: augenlawyers

- Published in Immigration Law

How to file divorce in MA

If you have decided to end your marriage, you may choose to file for divorce. You can file for divorce in Massachusetts if you have lived in the state for one year, or if the reason the marriage ended happened in Massachusetts and you have lived in Massachusetts as a couple.

In Massachusetts, a divorce may be filed as “no-fault” or “fault,” and either of these can be contested or uncontested. Before you file, you must choose which type is right for you.

1.Contested or uncontested

“Contested” means that one person disagrees with the divorce or the terms of the divorce. “Uncontested” means that both people agree about everything they file.

2. Fault or no-fault

There are seven “fault” grounds or reasons and also a “no fault” grounds. The “fault” grounds mean that one person was considered at fault in causing the marriage to end. Most people file “no fault” divorce. A “no fault” divorce is a divorce in which the marriage is broken beyond repair but where neither spouse blames the other. In Massachusetts, the no fault divorce grounds is called “Irretrievable Breakdown of Marriage.”

In a fault divorce, the person asking for the divorce must prove specific ground(s) or reason for the divorce. The following grounds are listed in Mass. General Laws chapter 208, section 1:

- Adultery

- Desertion

- Gross and confirmed habits of intoxication

- Cruel and abusive treatment

- Non-support

- Impotency

- A prison sentence of 5 or more years

This process can be more time-consuming and expensive than a no-fault divorce.

1A or 1B : No fault divorce

There are two kinds of “irretrievable breakdown” divorces. They are often referred to as “1A” and “1B”, referring to the section of the law under which they are found, Massachusetts General Laws Chapter 208.

The most common approach is no-fault based on an irretrievable breakdown of the marriage. There are 2 options for a no-fault divorce.

A “1A” divorce would be filed when both spouses agree that the marriage has irretrievably broken down and they have reached a written agreement with respect to child support, parenting time, alimony, child custody, and the division of marital assets. This is an uncontested no-fault divorce.

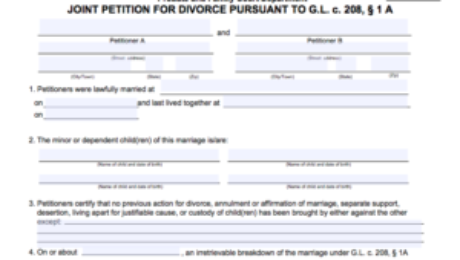

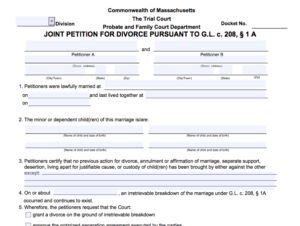

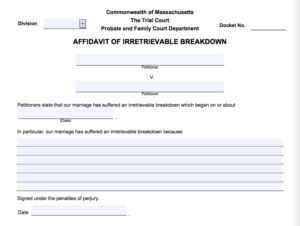

There are several important papers to file under “ 1A” category. Among them are two important documents as below:

(1) Joint petition for divorce under section 1A (CJD-101A) signed by both parties or their attorneys.

(2) Joint affidavit of irretrievable breakdown signed by the parties.

A “1B” divorce would be filed when one spouse believes there is an irretrievable breakdown of the marriage or both spouses believe the marriage has ended but they aren’t in agreement with regard to custody, support, or marital property issues. This is a contested no-fault divorce. If you and your spouse are able to come to an agreement, you can file a request to change the divorce complaint from a “1B” to a “1A”divorce.

Please find the most important papers under “ 1B”: Complaint for divorce under section 1B (CJD-101B) signed by one party.

Reference: https://www.mass.gov/

Disclaimer: The Contents of this web site is for informational purposes and should not be considered legal advice. This web page may be considered advertising under Massachusetts Supreme Judicial Court Rules, and it does not establish an attorney-client relationship

We invite you to contact us and welcome your calls, letters and electronic mail. Contacting us does not create an attorney-client relationship. Legal advice and representation can only be obtained upon retaining our firm and the execution of a written agreement for the rendering of specific legal services. Augen Law Offices value your privacy and respect the attorney-client privilege

Augen Law Offices

Address: 21 McGrath Hwy, Suite 205, and Quincy, MA 02169

Email: kaugen@augenlaw.com

Tel: 857-526-6042

Wechat ID: augenlawyers

- Published in Family Law

Optional Practical Training (OPT) for F-1 Students

According to uscis official definition ,Optional Practical Training (OPT) is temporary employment that is directly related to an F-1 student’s major area of study.

Eligible students can apply to receive up to 12 months of OPT employment authorization before completing their academic studies (pre-completion) and/or after completing their academic studies (post-completion). However, all periods of pre-completion OPT will be deducted from the available period of post-completion OPT.

Types of OPT

All OPT must be directly related to the student’s major area of study. Students may participate in OPT in two different ways:

- Pre-completion OPT: F-1 students may apply to participate in pre-completion OPT after they have been enrolled in school for one full academic year. Students authorized to participate in pre-completion OPT must work part-time while school is in session. They may work full time when school is not in session.

- Post-completion OPT: F-1 students may apply to participate in post-completion OPT after completing their studies. Students authorized for post-completion OPT may work part-time (at least 20 hours per week) or full-time.

STEM OPT Extension

Students who have earned degrees in certain science, technology, engineering and math (STEM) fields may apply for a 24-month extension of their post-completion OPT employment authorization if they:

- Are an F-1 student who received a science, technology, engineering, or mathematics (STEM) degree included on the STEM Designated Degree Program List (PDF),

- Are employed by an employer enrolled in E-Verify, and

- Received an initial grant of post-completion OPT employment authorization based on their STEM degree

Applying for OPT: Generally, if you are an F-1 student who wants to apply for OPT, you must:

- Request that your designated school official (DSO) at your academic institution recommend the OPT. Your DSO will make the recommendation by endorsing your Form I-20 and making the appropriate notation in the Student and Exchange Visitor Information System (SEVIS).

- Properly file Form I-765, Application for Employment Authorization with USCIS, accompanied by the required fee and the supporting documentation as described in the form instructions.

- Published in Immigration Law

Expedite Reentry Permit Case

Augen Law Offices has recently helped a client with an Expedite Reentry Permit Case

A lawful permanent resident (LPR) normally may travel outside the United States and return; however, there are some limitations. A reentry permit can help prevent two types of problems:

- Your Permanent Resident Card becomes technically invalid for reentry into the United States if you are absent from the United States for 1 year or more.

- Your U.S. permanent residence may be considered as abandoned for absences shorter than 1 year if you take up residence in another country.

A reentry permit establishes that you did not intend to abandon status, and it allows you to apply for admission to the United States after traveling abroad for up to 2 years without having to obtain returning resident visa. Reentry permits are normally valid for 2 years from the date of issuance.

(1) How do I get a reentry permit?

To obtain a reentry permit, file Form I-131, Application for Travel Document. You should file this application well in advance of your planned trip.

(2) What will happen if I do not apply for a reentry permit before I travel outside of the United States?

If you are an LPR planning to travel outside of the United States for 1 year or more, it is important that you apply for a reentry permit before you depart the United States. If you stay outside of the United States for 1 year or more and did not apply for a reentry permit before you left, you may be considered to have abandoned your permanent resident status. If this happens, you may be referred to appear before an immigration judge to decide whether or not you have abandoned your status. If you are in this situation, contact the U.S. consulate about a returning resident visa.

(3) I am a LPR and need to travel abroad. Can I file my Form I-131 to get a reentry permit while I am outside the United States?

No. You cannot file a Form I-131 to obtain a reentry permit unless you are physically present in the United States when you file the form.You should file your Form I-131 no fewer than 60 days before you intend to travel abroad.

(4) If I file Form I-131 to get a reentry permit while I am in the United States, will USCIS deny the Form I-131 if I leave the United States while the form is still pending?

We recommend that you file Form I-131 while you are in the United States. However, you do not have to be in the United States for USCIS to approve your Form I-131 and issue

a reentry permit to you if your biometrics (photo, fingerprints) have been obtained. You can indicate on your Form I-131 that you want USCIS to send your reentry permit to a U.S. Embassy, consulate or a DHS office overseas, so you can pick it up from one of those facilities.

(5) If I file Form I-131 for a reentry permit while I am in the United States, can I submit my biometrics while I am outside the United States?

No. When you file your Form I-131 to obtain a reentry permit, USCIS will notify you when to appear at a designated Application Support Center (ASC) to obtain your biometrics. You must provide your biometrics at the ASC while you are in the United States. If you leave the United States before you provide your biometrics, USCIS may deny your application.

(6) What if I must leave the United States before I can file a Form I-131 for a reentry permit?

You do not need a reentry permit if you will be outside the United States for less than 1 year. If you have been outside the United States for less than 1 year, you may use your Permanent Resident Card (Form I-551) as your travel document.

(7) I have an old reentry permit. Do I need to turn in my old permit if I am filing for a new one?

Reentry permits cannot be extended. If your permit expires, you’ll need to apply for a new one. If you have a valid reentry permit in your possession, you will need to send it in when you apply for a new one. You need not send in an expired reentry permit.

For security reasons, USCIS will not issue a new reentry permit to someone who already has a valid one in his or her possession. If you need a new reentry permit because your previous one was lost, stolen, or destroyed, please indicate this on your application for the new permit.

Legal Source: https://www.uscis.gov/sites/default/files/USCIS/Resources/B5en.pdf

- Published in Immigration Law